A Transformative Investment for Hanover County

The Hunting Hawk Technology Park represents a transformative investment in Hanover County – proposing a campus that will strengthen the county’s digital infrastructure and economy for decades to come. With strong environmental protections, low water use, quiet operations, and extensive natural buffers, the project would deliver the technology our community depends on while preserving the area’s character. At full build-out, it will generate millions in new local revenue with minimal impact on nearby neighborhoods or public services, creating long-term value for Hanover and its residents.

Designed with Care

The project is designed with strong safeguards to protect surrounding communities, natural resources, and the Chickahominy River corridor.

Low Water Use

Modern closed-loop cooling eliminates evaporation and requires only about 10,500 gallons per day for employees, similar to 30 homes, with on-site wells supplying the water.

Noise Control

All buildings and equipment must comply with Hanover’s noise ordinance, with post-construction testing required and mandatory corrective action if needed.

Protected Land

At least 40% of the property will remain preserved open space, including the Resource Protection Area along the Chickahominy River.

Air Quality

Backup generators meet strict EPA Tier 4 standards, reducing emissions and minimizing impacts to nearby schools and neighborhoods.

Visual Screening

Wide buffers, preserved mature forest, and additional planting and berms ensure buildings and lights are not visible from adjacent properties.

Strengthening the Local Economy

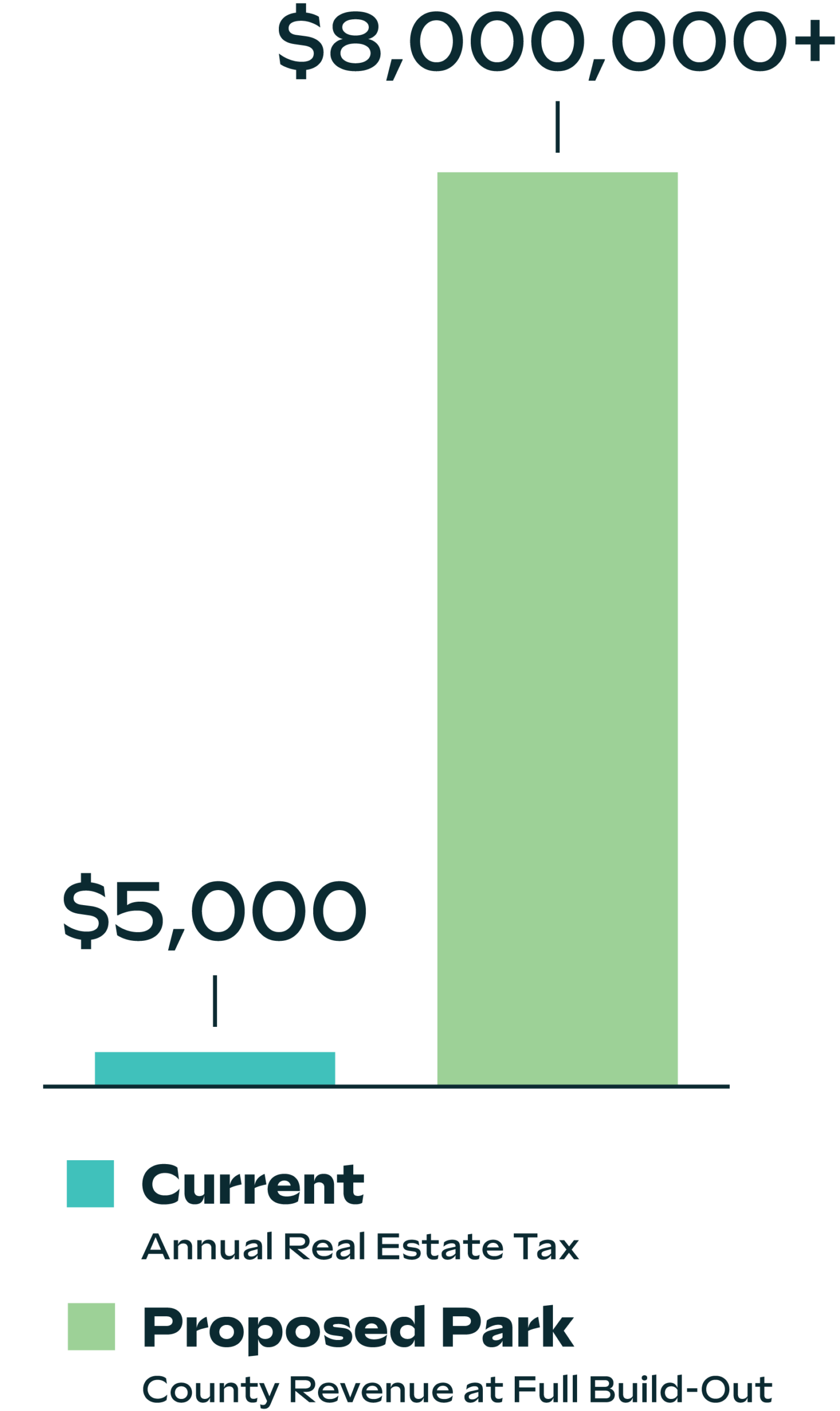

The Hunting Hawk Technology Park could provide a major long-term financial benefit to Hanover County.

By transforming a property that currently generates minimal tax revenue into a modern technology campus, the project could create a significant new source of funding for the community. These revenues could help support public schools, strengthen public safety services, improve local infrastructure, and reduce the burden on residential taxpayers.